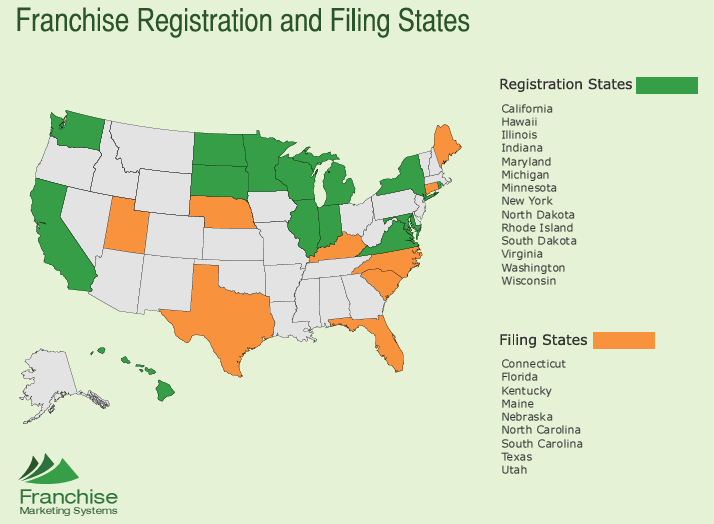

The Franchise State Registration Process requires that a Franchise Model is registered or filed in certain states in order to offer or market a franchise program.

The included map documents states that either have filing or registration processes in place. The Green States require the payment of a fee and the submission of the Franchise Disclosure while the orange states only require the submission of a filing form.

These States require registration and approval of Franchise Disclosure Document prior to selling in the state or from the state. These fees can and may change depending on the state regulators.

California Department of Financial Protection and Innovation 2101 Arena Boulevard, Sacramento, CA 95834

Franchise Registration Fee California $ 675

Commissioner of Securities Department of Commerce and Consumer Affairs Business Registration Division Securities Compliance Branch 335 Merchant Street, Room 203, Honolulu, HA 96813

Franchise Registration Fee Hawaii $125

Franchise Division Office of Attorney General 500 South Second Street

Franchise Registration Fee Illinois $500

Franchise Division Office of Secretary of State 302 W. Washington St., Rm. E111 Indianapolis, IN 46204

Franchise Registration Fee Indiana $500

Office of the Attorney General Division of Securities 200 St Paul Place Baltimore, Maryland21202-2020

Franchise Registration Fee Maryland $ 500

Michigan Attorney General’s Office

Consumer Protection Division

Attn: Franchise Section

525 W. Ottawa Street

Williams Building, 1st Floor

Lansing, MI 48933

Franchise Registration Fee Michigan $ 250

Minnesota Department of Commerce

Securities Unit

85 7thPlace East, Suite 280

St. Paul, MN 55101-2198

Franchise Registration Fee Minnesota $400

North Dakota Securities Department

600 East Boulevard Ave., State Capital Fifth Floor, Dept. 414

Bismarck, ND 58505-0510

Franchise Registration Fee North Dakota $250

New York State Department of Law

Investor Protection Bureau

28 Liberty Street, 21st Floor

New York, NY 10005

Franchise Registration Fee New York $750

Corporate Securities Section

Dept. of Insurance & Finance

Labor & Industries Bldg.

Salem, or 97310

Franchise Office Division of Securities John O. Pastore Office Complex 1511 Pontiac Avenue, Bldg. 69-1 Cranston, RI 02910

Registration Fee Rhode Island $ 500

Department of Labor and Regulation

Division of Insurance

Securities Regulation

124 S. Euclid Suite 104

Pierre, SD 57501

Registration Fee South Dakota $ 250

State Corporation Commission Division of Securities and Retail Franchising 1300 E. Main St. 9th Floor Richmond, VA 23219

Registration Fee Virginia $ 500

Department of Financial Institutions

Securities Division

150 Israel Rd SW

Tumwater, WA 98501

Registration Fee Washington $ 600

Department of Financial Institutions Division of Securities 345 West Washington Ave., 4th Floor Madison, WI 53703

Registration Fee Wisconsin $ 400

Download the FTC Franchise Rule Compliance Guide now.

Part 436 sets forth those amendments to the Franchise Rule pertaining to the offer and sale of franchises.

Part 437 sets forth a revised form of the original Franchise Rule pertaining solely to the offer and sale of business opportunities.

The following States do not require filing or registration to be able to sell Franchises in the State. They only require that the Franchisor follow the FTC Guidelines and have an approved FDD.

A Filing State is one that requires the Franchisor to file and pay a fee, but does not require the Franchisor to submit documents and seek approval to sell Franchises, like a registration State.

For Support

We’re Here to Help Right Away

For support and franchise registration or franchise filings in States across the U.S., contact us:

800-610-0292 / [email protected]